Collateral Is Not Required for Most Short Term Financing

For a corporation equity capital is obtained from. Collateral or assets are not required for all.

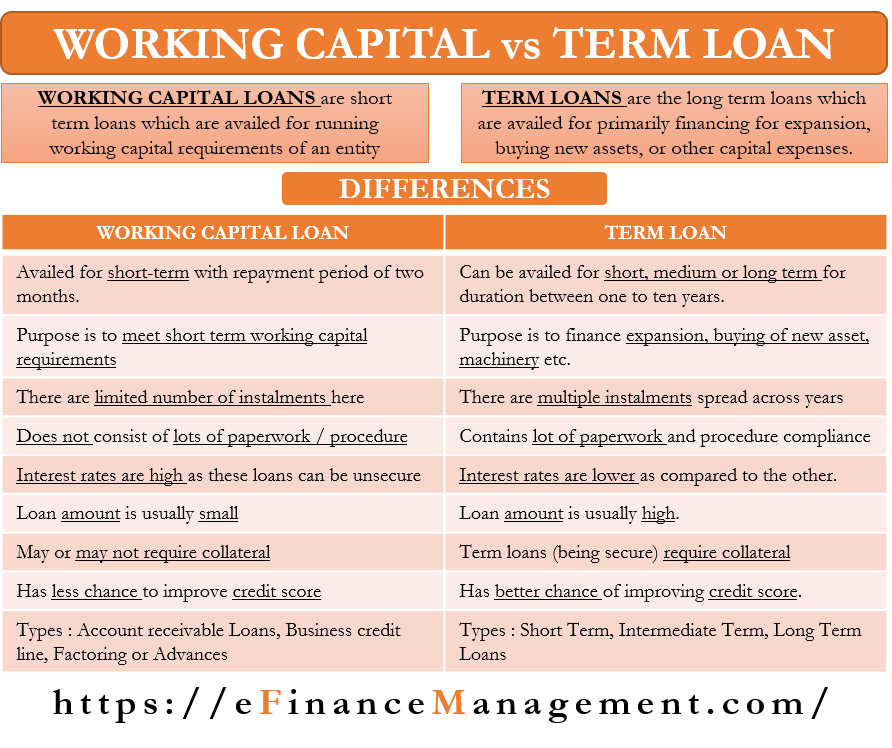

Working Capital Vs Term Loan All You Need To Know

As the name suggests unsecured loans have no collateral requirement.

. Collateral is not required for most short-term financing. You are not required to provide any collateral before your loan is approved. Our discrete fast and convenient cash loans from 2500 to 1000000 do not require a credit check monthly payments employment or income verification and will remain strictly confidential.

B line of credit. Most mature corporations distribute ____ of their after-tax profits as dividends to stockholders. The Basics of Collateral.

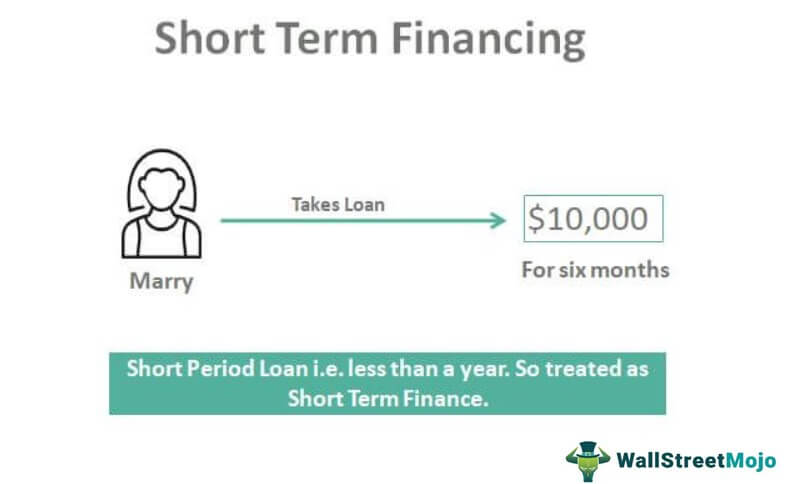

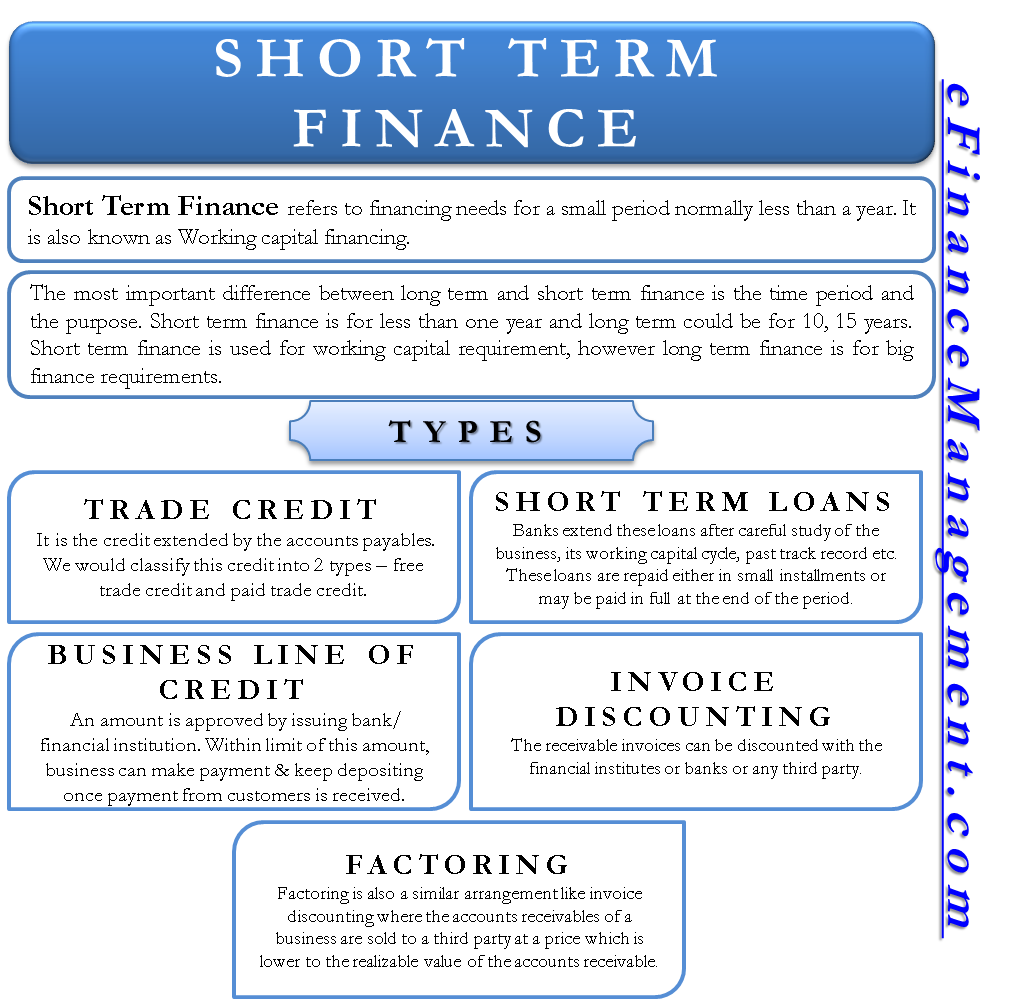

Require pymt in short term. Financing through accounts receivable can be done either by pledging the receivables or by selling them outright a process called factoring in the United States. Short-Term Financing is a way of meeting the financial requirements of the companies for a short period ie 15 days to 1 yearThese finances are generally used for making daily expenses purchasing material and paying tax.

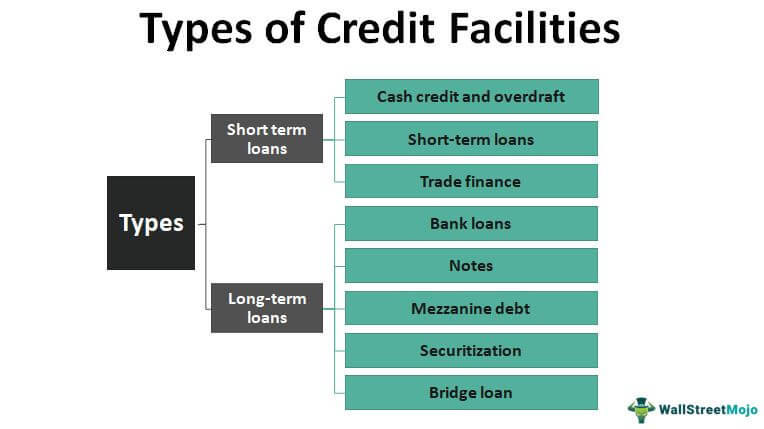

A bridge loan is a type of short-term loan typically taken out for a period of two weeks to three years pending the arrangement of larger or longer-term financing. C short-term self-liquidating loan. B a warehouse on the borrowers premises.

It is interim financing for an individual or business until permanent or next-stage financing can be obtained. Short-term financing is used to increase the current assets to increase the working capital of the firm. Some examples of collateral are cars real estate stocks bonds and more.

The term length is usually up to 2 years and of course requires no collateral. Its the simplest form of lending to understand. D single payment note.

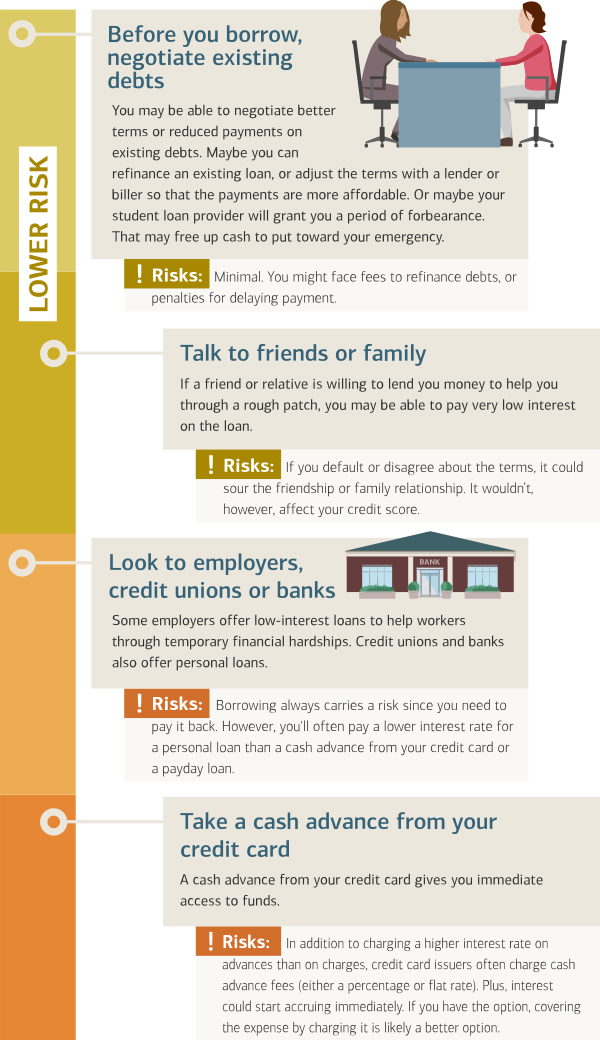

In order to repay some corporate bonds a firm may be required to deposit a specified sum of money each year until the bonds maturity in a sinking fund. Not all loans require collateral especially if the borrower doesnt have any property to offer. We will walk through the process to help you better understand if you are a fit for this type of financing.

This is similar to every no collateral business loan provider. Short term financing is less restrictive than long term financing. Our no collateral loans are easily accessible.

Collateral is typically required for a A secured short-term loan. In such a case there are several ways to borrow money including. Up to 25 cash back 46.

In just a few days your loan can be approved and paid to your business bank account. Using your Accounts Receivable as collateral may be the best option for many small businesses. This makes this a great option for you if you dont have the collateral required for other funding options or if you would rather not.

In this manner it becomes a very cost-efficient mode of financing. A terminal warehouse is A a warehouse located at the airport. C a central warehouse storing the merchandise of several businesses.

They expand and contract w activity. Collateral is a term used to describe and help assure lenders that a borrower will repay their loan amount. Short-term financing needs not collateral or security.

Since the loan is for a shorter period ie less than one year it will be treated as short-term finance. Collateral is a way for lenders to protect themselves if monthly payments can not be made by a business. You should know the following things about our no collateral business loans.

Occur in normal course of business. After six months the marriage has to repay the loan amount and the interest due. When most people think of a traditional business loan they are referring to an unsecured short-term loan.

Collateral is a huge sticking point on traditional banks loans. Collateral security are the additional security which banker may ask to provide to the firm to have more surety against the loan. The time between when the benefit or cash is received and the obligation satisfied provides short-term financing.

Collateral normally not required though some creditors may have specific legal claims. Short-term financing not backed by collateral is called. Ideal Luxury will make you a short term collateral loan secured by your fine watches diamonds jewelry or other luxury items.

You get a lump sum of cash infusion on a fixed interest rate that you pay back based on a loan term length. Marry took a loan of 10000 for six months at the 5 APR. Example of Short Term Finance.

From the name itself unsecured loans dont give the lender any form of assurance or protection that the money will be returned. Short-term financing is riskier than long-term financing because the default in payment may create legal problems. Short-term financing not backed by collateral is called.

Stock of goods can be offered as collateral security against the short term loan. Business loans that use tangible assets as collateral are called secured loans as opposed to unsecured loans. The advantage of a secured business loan is that they often have lower interest rates than unsecured loans a higher chance of qualification and more business loan options which leads to better terms.

The most common types of collateral used for short-term credit are accounts receivable and inventories. Short term loans are taken by the firm to meet out the short term requirement of the business. Se 3 ways that this practice can help small businesses increase their working capital to promote their growth with minimal risk or long-term liability.

Contraction And Landscaping Industry Loans Small Business Loans Small Business Funding Financial Help

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Collateral Free Working Capital Loan 30 Lakhs To 5 Crores Balaji Credit Business Loans Small Business Growth Loan

Short Term Financing Personal Finance Lab

Americas Small Business Funding Experts Since 1996 Small Business Loans Small Business Funding Business Loans Small Business Loans

Collateral Free Business Loans Business Loans Small Business Loans Loan

Business Loans Experts Get Business Loans And Unsecured Business Cash Advance With No Collateral With Easy Repayment Business Loans Small Business Loans Loan

Short Term Financing Definition Example Overview Of Top 5 Types

Applying For Your Loan Mortgage Mortgage Loans Loan Application

We Love This Business Factoring Infographic Business Infographic Business Finance

Types Of Credit Facilities Short Term And Long Term

Short Term Financing Characteristics Advantages And Disadvantages Corporate Finance

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Personal Finance Organization

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

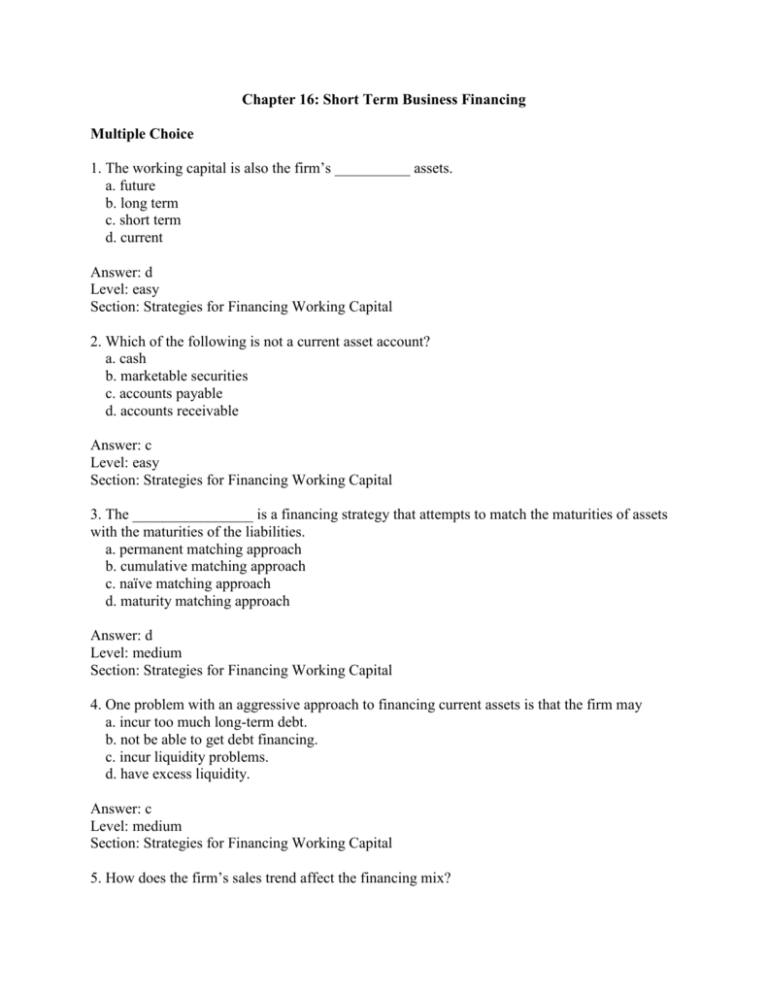

Chapter 16 Short Term Business Financing Multiple Choice 1 The

Short Term Finance Types Sources Vs Long Term Efinancemanagement

Working Capital Financing What It Is And How To Get It

Web Up Go Branding Video Video Event Marketing Development Marketing Collateral

Comments

Post a Comment